The economy looms large in the minds of most people and not simply because it is an election year. It affects us directly. We spend a lot of our waking hours at work, and our jobs are often connected to the welfare of families and children. With everything being more expensive, getting a toe hold on mere middle-class status is harder now than it was for older generations. Many people are slipping down a rung or three.

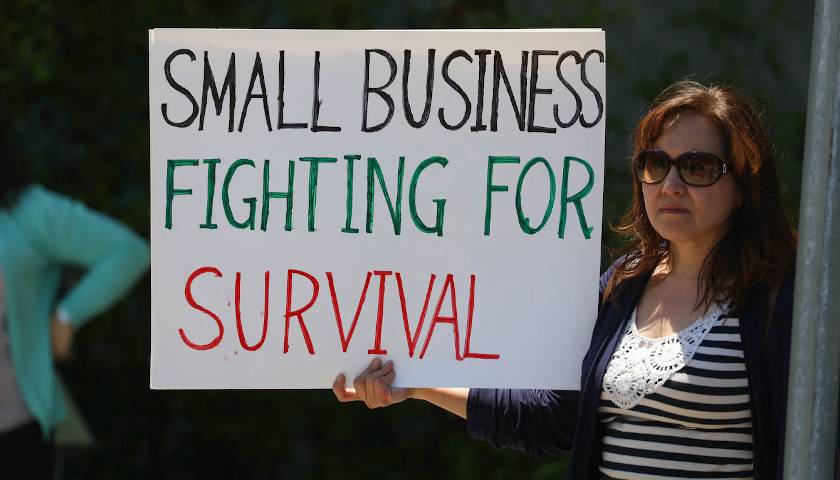

In addition to long-term trends like the decline of manufacturing and the cut-throat financialization of corporate America, unique recent events loom large. COVID lockdowns, soon followed by the government money giveaway—PPP loans, augmented unemployment benefits, rent relief, and other stimulus plans—disrupted our routines and affected the entire economy. While these measures likely prevented a deep recession, the shutdowns ruined a lot of businesses, and the various stimulus funds ended up unleashing inflation.

Read More