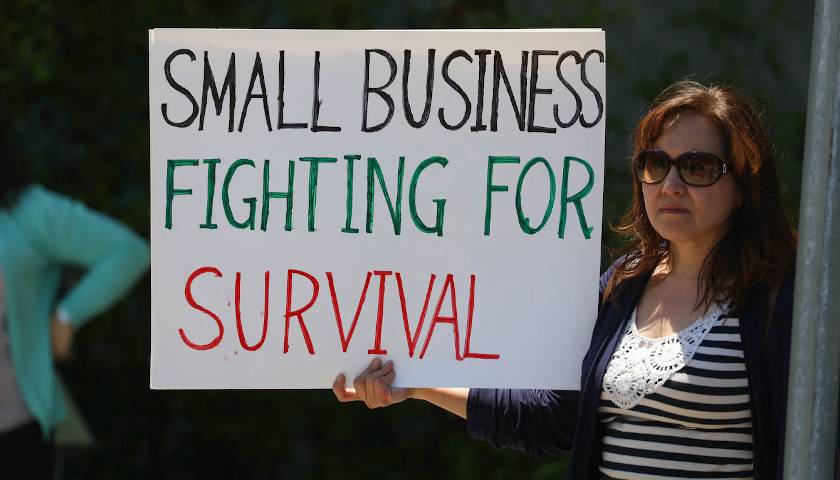

A large portion of small business owners are concerned about their future amid wider financial stress under President Joe Biden, according to a new poll from the Job Creators Network Foundation (JCNF) obtained exclusively by the Daily Caller News Foundation.

Around 67 percent of small business owners were worried that current economic conditions could force them to close their doors, ten percentage points higher than just two years ago, according to the JCNF’s monthly small business poll. Respondents’ perceptions of economic conditions for their own businesses fell slightly in the month, from 70.2 to 68.1 points, with 100 points being the best possible business conditions, while perceptions of national conditions increased from 50.4 to 53.2 points.

Read More