The Federal Reserve cut interest rates on Wednesday for the first time since the COVID-19 pandemic. Many observers of Fed activity had predicted a quarter-point reduction but the central bank wound up cutting rates by a half-point.

Read MoreTag: interest rate

Fed Chair Powell Indicates Bank Ready to Start Cutting Its Key Interest Rate

Federal Reserve Chairman Jerome Powell on Friday indicated the bank is prepared to start cutting its key interest rate from its 23-year high, as inflation falls to more historic rates and the job market cools.

Read MoreFederal Reserve Holds Interest Rates Steady at 23-Year High

The Federal Reserve on Wednesday decided to hold interest rates steady at a 23-year high, a decision that was expected.

Read MoreFed Continues Rate Pause with Cuts on the Horizon

The Federal Reserve announced on Wednesday that it would not change its benchmark federal funds rate, but does project rate cuts later this year.

The Fed’s decision not to raise rates keeps the target range between 5.25% and 5.50%, the highest level since 2001, marking the fourth meeting in a row where the Fed chose to not adjust the rate, according to an announcement from the Federal Reserve following a meeting by the Federal Open Market Committee (FOMC). Investor projections for upcoming FOMC meetings are increasingly predicting a rate cut, with the market calculating around 58% odds that the rate will be reduced in March as of Jan. 31, according to CME Group.

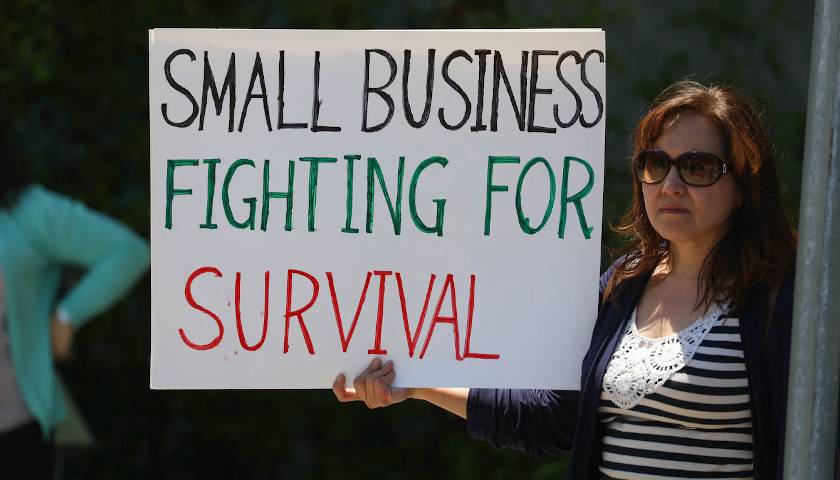

Read MoreBusinesses Are Getting Crushed ‘Beneath the Surface’ of Economy, New Figures Show

In recent years, mid-sized companies between $100 million and $750 million in yearly revenue have been increasingly struggling compared to large businesses, taking the brunt of poor economic conditions and high interest rates, according to asset manager Marblegate.

From 2019 to the end of 2022, mid-sized companies had a 24 percent drop in earnings before interest, taxes, depreciation and amortization (EBITDA) compared to public companies, which had their earnings rise 18 percent, according to a study by Marblegate acquired by Axios. The discrepancy between large and midsized companies is in part due to the increased cost of credit for smaller businesses, which are more affected by the Federal Reserve’s interest rate hikes, with the federal funds rate currently being placed in a range of 5.25 percent and 5.50 percent, the highest point in 22 years.

Read More