Republican California Rep. John Duarte unveiled his plan to save American farmers from possible financial ruin due to long-standing Chinese tariffs in an exclusive interview Wednesday with the Daily Caller News Foundation.

Read MoreTag: interest rates

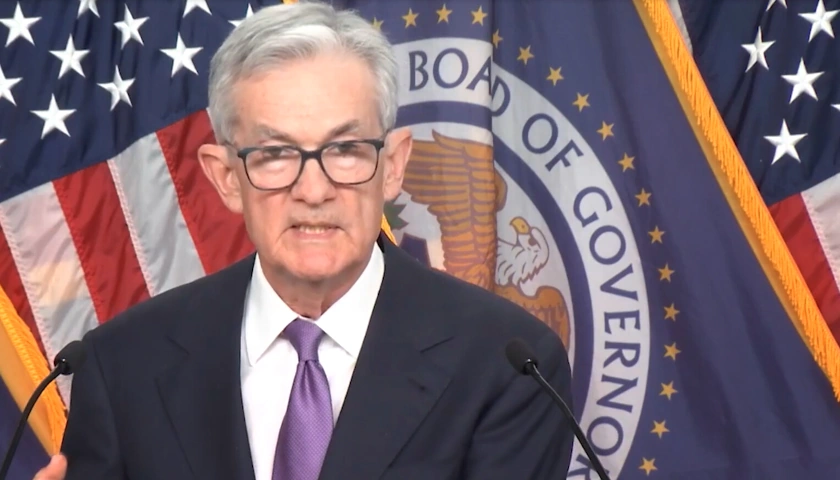

As Inflation and Labor Cools, Traders Look to the Fed for Hints at a September Rate Cut

The Federal Reserve is expected to hold the bank’s key interest rate steady this week. Traders currently expect three rate cuts this year beginning in September.

Read MoreFederal Reserve Keeps Key Interest Rate, Signaled Just One Cut Is Expected Before Year’s End

The Federal Reserve on Wednesday kept its key interest rate but signaled one cut is expected before the end of the year.

Read MoreCompanies are Slashing Away at Debt as Surging Inflation Casts Shadow over Interest Rate Cuts

Many companies are looking to cut down on their debts as recent high inflation reports have made borrowing more expensive as the prospect of interest rate cuts by central banks diminishes, The Wall Street Journal reported Wednesday.

Even companies with already high credit outlooks are deleveraging to boost their rating with top agencies and reduce debt costs that have increased along with interest rates, while firms with lower ratings are needing to cut debt to maintain profitable operations, according to the WSJ. Investors have had to adjust their view about when interest rates might decline in recent weeks as persistently high levels of inflation have made it less likely that central banks around the world, including in the U.S., will cut interest rates, reducing the cost of holding debt.

Read MoreU.S. Potentially Facing New Era of High Interest Rates

The United States could be facing an era of prolonged high interest rates unlike anything seen in recent memory.

According to Axios, a number of major factors indicate that high interest rates could be the new norm in the U.S., including the movement of rates, the rate of inflation, and the recent outlook for the Federal Reserve’s policy in addressing these issues.

Read MoreMortgage Applications Fall as Interest Rates Remain High

Mortgage applications sank last week as high prices and rising mortgage rates have increased unaffordability for average Americans, according to data from the Mortgage Bankers Association.

The total volume of mortgage loan applications for homes declined 10.6% in the week ending Feb. 16 compared to the previous week when seasonally adjusted, while the purchase index fell 10% in that same time, according to a release from the MBA. The drop in applications follows an increase in the average interest rate for a 30-year fixed-rate mortgage for homes under $766,550 to 7.06% from 6.87% the week prior, intensifying housing unaffordability.

Read MoreCorporate Media in Crisis as Outlets Grapple with Biden’s Economy

Numerous legacy media outlets are struggling with challenges posed by President Joe Biden’s economy and resorting to drastic measures, Axios reported on Friday.

Close to a dozen of these outlets are firing workers, dealing with employee strikes or looking to sell, according to Axios. The Federal Reserve’s imposition of high interest rates to bring down inflation is hindering their ability to accumulate more debt, complicating their efforts to extend the timeline for resolving their financial difficulties.

Read MoreSmaller Banks’ Earnings Limp as High Interest Rates, Sector Turmoil Send Customers Fleeing to Megabanks

Many smaller banks posted dismal fourth quarter earnings as depositors continue to flee to booming megabanks that have been unfazed by interest rate hikes and a crisis that shook the sector early last year, according to The Wall Street Journal.

Net income was down substantially at many small and regional banks in the fourth quarter, including KeyCorp, Citizens Financial Group, PNC Financial Services Group, Comerica and Zion Bancorporation, falling 90%, 70%, 40%, 90% and 50%, respectively, according to the WSJ. Despite the poor performance at the small and regional level, America’s megabanks — JPMorgan, Bank of America, Wells Fargo and Citigroup — saw their earnings increase 11% during 2023 to over $100 billion.

Read MoreCloud Hangs over Commercial Real Estate as Trillions in Debt Set to Come Due

Commercial real estate is facing a mountain of debt that many borrowers could have trouble refinancing due to a rapid hike in interest rates and record vacancies, according to The Wall Street Journal.

Around $2.81 trillion in commercial real estate loans are set to expire through 2028, meaning borrowers would either have to pay the amount outright or refinance the debt with higher interest rates, according to data from market research group Trepp. Payments on commercial mortgages are typically only for interest while the loan is active, and when the loan reaches its expiration date, borrowers often refinance at current rates, but doing so would increase payments drastically in a time when commercial developers and property owners are strapped for cash, according to the WSJ.

Read More