by Will Kessler

In recent years, mid-sized companies between $100 million and $750 million in yearly revenue have been increasingly struggling compared to large businesses, taking the brunt of poor economic conditions and high interest rates, according to asset manager Marblegate.

From 2019 to the end of 2022, mid-sized companies had a 24 percent drop in earnings before interest, taxes, depreciation and amortization (EBITDA) compared to public companies, which had their earnings rise 18 percent, according to a study by Marblegate acquired by Axios. The discrepancy between large and midsized companies is in part due to the increased cost of credit for smaller businesses, which are more affected by the Federal Reserve’s interest rate hikes, with the federal funds rate currently being placed in a range of 5.25 percent and 5.50 percent, the highest point in 22 years.

“Beneath the surface of the ticker-tape economy made up of large public companies is the real economy — the middle market — with more limited access to capital,” Marblegate wrote in the report, according to Axios.

Companies with between $100 million and $750 million in revenue make up a total of one-third of the private sector in terms of gross domestic product, employing around 50 million people, according to Marblegate. Bankruptcies for companies in this range increased heavily in 2023 and were responsible for a “vast majority” of the year’s corporate failures.

Companies with between $100 million and $750 million in revenue make up a total of one-third of the private sector in terms of gross domestic product, employing around 50 million people, according to Marblegate. Bankruptcies for companies in this range increased heavily in 2023 and were responsible for a “vast majority” of the year’s corporate failures.

Corporate bankruptcies made a big comeback last year. pic.twitter.com/STtzYY4y0X

— Leo (@LeoNelissen) January 8, 2024

Businesses are facing tighter operating conditions as the labor market remains constricted, with unemployment remaining consistently below 4 percent, most recently 3.7 percent in December. The country added 216,000 nonfarm payroll jobs in December, with 52,000 of those being government positions, bringing the number of government employees to an all-time record of over 23 million.

The profitability margin on EBITDA revenue for mid-sized companies fell 25 percent between 2019 and the end of 2022, while the Russell 3000, a measure of American public companies, had margins fall only 2 percent, according to the report. In that time frame, mid-sized businesses’ ratio of debt to revenue rose by 62 percent as opposed to publicly traded companies, which fell by 14 percent.

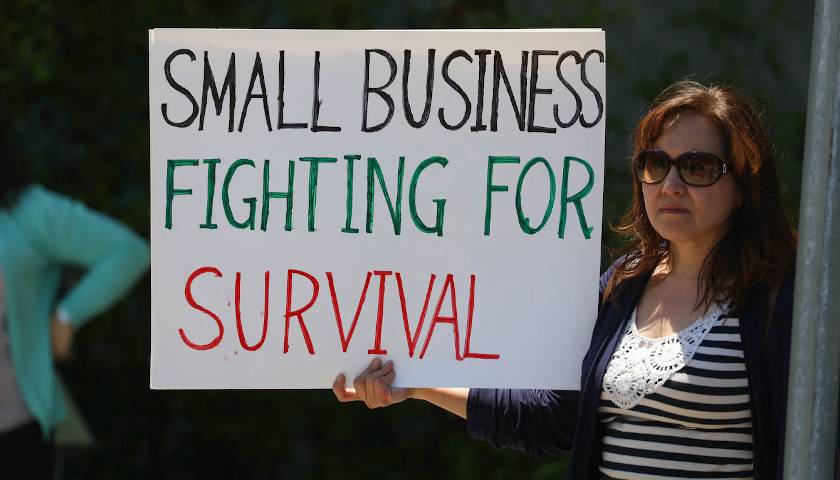

Small businesses have also felt the effects of harsh economic conditions, with 76 percent saying they had not seen the typical increase in sales during the holiday season. The decline in sales follows high inflation, with prices having risen more than 17 percent since President Joe Biden took office, and a decline in savings held by average Americans.

– – –

Will Kessler is a reporter at Daily Caller News Foundation.