As part of an investigation into possible collusion with climate activists, the House Judiciary Committee has sent letters to 60 U.S.-based asset management companies asking them for information about activities related to their membership with the Glasgow Financial Alliance for Net Zero and Net Zero Asset Managers.

Read MoreTag: ESG

Two Major Banks Leave United Nations’ Net Zero Banking Alliance Within Two Weeks

Not soon after the general election, and within two weeks of each other, two major financial institutions have left a United Nations Net Zero Banking Alliance (NZBA).

This is after they joined three years ago, pledging to require environmental social governance standards (ESG) across their platforms, products and systems.

Read MoreESG Firms Invested in Coal Industry They Tried to Reduce, While Reaping Big Profits, Lawsuit Alleges

The State of Texas has been a leader in the pushback against environmental, social and governance (ESG) policies, passing some of the first anti-ESG laws in the country. Last week, Texas Attorney General Ken Paxton moved to protect the coal industry from what Paxton says is an effort on the part of large investment firms to not only shrink coal companies — but also unfairly profit from them.

Read MoreHouse Passes Bills to Protect Employee Benefit Plans from Politicization

A package of bills to ensure employee benefits plans prioritize financial well-being over “woke” policies has been passed by the U.S. House of Representatives.

Outgoing Virginia Republican Rep. Bob Good sponsored the Protecting Americans’ Investments from Woke Policies Act and the No Discrimination in My Benefits Act, which cleared the House 217-206.

Read MoreWoke 2.0: ESG Critics Say the Same Movement Marches on, Only with a New Name

BlackRock began renaming environmental, social and governance (ESG) earlier this year. It’s now calling it “transition investing.”

The company recently updated its climate and decarbonization stewardship guidelines. The document makes no mention of ESG, but it shows in many ways, the world’s largest investment manager with $10 trillion in assets under management is still pursuing many of the same goals.

Read MoreGov. McMaster Signs Bill to Ban ESG from South Carolina’s Retirement System

South Carolina Gov. Henry McMaster ceremonially signed a measure mandating the state’s retirement system to consider only “pecuniary factors” when making investment decisions.

H.3690, the ESG Pension Protection Act, effectively bans the South Carolina Retirement System Investment Commission from weighing environmental, social and governance factors and orders the system to maximize the highest rate of return for beneficiaries. The state House passed the measure by a 103-5 margin, while the state Senate passed it 45-0.

Read MoreCorporate America is Starting to Shy Away from Woke Business as Backlash Mounts

American companies are reversing the multiyear trend of hiring more employees in roles related to environmental, social and corporate governance (ESG) issues in an effort to increase profitability and address investor pushback, according to The Wall Street Journal.

U.S. companies shed 3,071 employees with positions related to ESG in December while only adding 2,897, continuing the trend that has been seen in half of the months in the last year of a net loss of ESG positions, according to the WSJ. The shift is in response to investors pulling their funds from companies heavily involved in ESG practices and placing their money in firms where they can get higher returns.

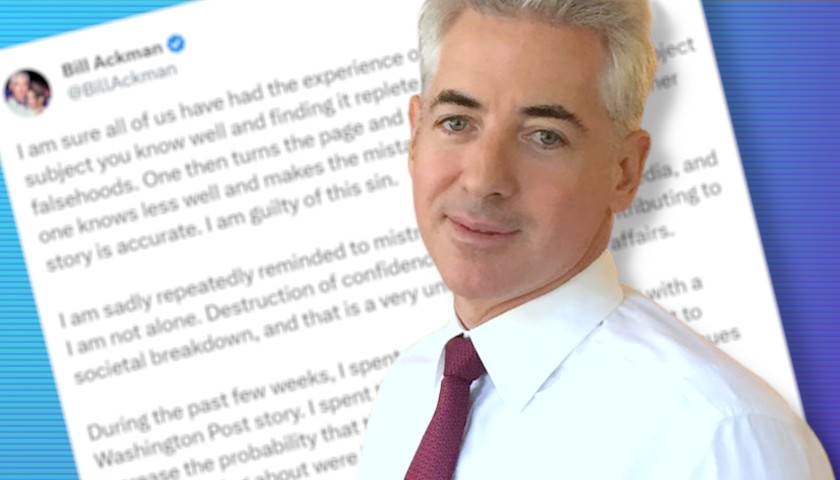

Read MoreBill Ackman on Washington Post Hit Piece: ‘The Public Has Been Again Misled’

Bill Ackman, the highly successful investor and Harvard graduate whose criticism of Claudine Gay’s history of plagiarism led to her resignation as President of Harvard University, published a lengthy tweet on his X account Saturday evening responding to an article about him published by The Washington Post earlier in the day, “How a liberal billionaire became America’s leading anti-DEI crusader.”

Read MoreCommentary: To Rebuild Trust, U.S. Banks Have a Lot of Work to Do

Trust in banks has plummeted. From 2019-2022, the percentage of people who believe banks and financial institutions have a positive effect on the country fell among Republicans (from 63 to 38 percent) and Independents (by nine points). The problem grows every time a right-of-center group is debanked. Recognizing the problem, “rebuilding trust” is the theme of the World Economic Forum in Davos, Switzerland. The path to rebuild trust in finance is simple—keep politics out of banking.

In spite of an alleged priority of building trust, the largest banks are aligning themselves with radical United Nations (UN) climate initiatives linked to radical efforts to reduce Africa’s population and destroy Sri Lankan agriculture.

Read More