The State of Texas has been a leader in the pushback against environmental, social and governance (ESG) policies, passing some of the first anti-ESG laws in the country. Last week, Texas Attorney General Ken Paxton moved to protect the coal industry from what Paxton says is an effort on the part of large investment firms to not only shrink coal companies — but also unfairly profit from them.

Read MoreTag: BlackRock

State AGs Sue Three of the World’s Biggest Asset Managers for Allegedly Violating Antitrust Laws

Texas Attorney General Ken Paxton is leading 10 other GOP state attorneys general in a lawsuit against BlackRock, State Street Corporation and Vanguard Group, three of the largest asset managers worldwide, for allegedly violating antitrust laws.

The firms allegedly conspired to use anticompetitive trade practices to artificially constrict the coal market, according to Paxton’s office. They acquired substantial stockholdings in all significant, publicly held coal producers in the U.S., allowing them to have the power to control coal company policies. These asset managers pushed for reduced coal output by more than half by 2030.

Read MoreInvestment Giants Leveraged Texas Universities’ Endowment Funds to Back Anti-Oil Agenda, Report Finds

Several asset managers leveraged two major Texas university systems’ endowment funds to advance anti-fossil fuel shareholder proposals in 2022 and 2023, according to a report from the conservative watchdog group American Accountability Foundation (AAF).

BlackRock-owned Aperio Group, Cantillon, former Vice President Al Gore-chaired Generation Investment Management, GQG Partners and JP Morgan Asset Management collectively manage approximately $4 billion for The University of Texas/Texas A&M Investment Management Company (UTIMCO) as of July, which handles the university systems’ endowments.

Read MoreMajor Beer Company Becomes Latest to Scrap Diversity Policies

Molson Coors announced Tuesday it would walk back a number of its diversity, equity and inclusion (DEI) policies, joining a number of other major U.S. corporations that have revoked such practices this summer.

The company will ensure “executive incentives” are not tied to meeting “representation” targets, end its participation in the Human Rights Campaign’s (HRC) Corporate Equality Index and axe its “supplier diversity” efforts, according to a memo obtained by the Daily Caller News Foundation. Several other companies have taken similar measures, including home improvement retailer Lowe’s and Ford Motors.

Read MoreWoke 2.0: ESG Critics Say the Same Movement Marches on, Only with a New Name

BlackRock began renaming environmental, social and governance (ESG) earlier this year. It’s now calling it “transition investing.”

The company recently updated its climate and decarbonization stewardship guidelines. The document makes no mention of ESG, but it shows in many ways, the world’s largest investment manager with $10 trillion in assets under management is still pursuing many of the same goals.

Read MoreFormer Blackrock Adviser Argues at Energy Forum that Divesting from Oil and Gas is Not Sustainable

The environment, social and governance (ESG) investing movement has faced a lot of criticism over the past couple years for undermining fiduciary responsibility and pushing progressive agendas through an undemocratic process.

At the Energy Future Forum presented by RealClearEnergyWednesday, Terrence Keeley, author and former senior advisor at Blackrock, argued that ESG is also misallocating resources and doing nothing for the environment it claims to protect.

Read MoreTexas Schools Pull $8.5 Billion from BlackRock over ESG

The Texas Permanent School Fund (PSF) is pulling $8.5 billion from the investment firm BlackRock over its use of environmental, social and governance (ESG) policies.

The board informed the investment firm that it was being terminated as the manager of the Navarro 1 Fund in a Tuesday letter, which it provided to the Daily Caller News Foundation. The divestment represents the largest from the private firm, according to Fox Business Network.

Read MoreLawmakers Aim to Ban Colleagues from Market Trading While They Still Buy and Sell

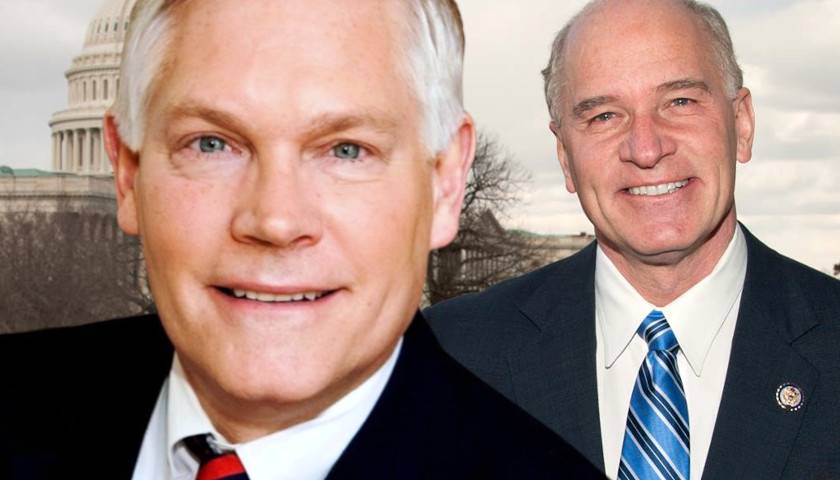

Four members of Congress recently reported buying and selling financial assets, despite co-sponsoring a bill that would ban such trades, disclosures show.

Democratic Reps. Mary Gay Scanlon of Pennsylvania, Jeff Jackson of North Carolina, Bill Keating of Massachusetts and Republican Rep. Pete Sessions of Texas all reported selling or purchasing assets after they signed on as co-sponsors of the TRUST In Congress Act, financial disclosures show. The TRUST In Congress Act would ban members of Congress from directly trading covered investments, which includes securities, commodities futures and similar assets by requiring them to place such assets in a blind trust.

Read MoreBlackRock to Make Massive Infrastructure Move to ‘Decarbonize the World’ and Reap Government Subsidies

BlackRock on Friday reached an agreement to acquire Global Infrastructure Partners for $12.5 billion, a move aimed at advancing the investment giant’s climate objectives and capitalizing on government subsidies, according to statements and reports.

BlackRock is the world’s largest asset manager and is a proponent of environmental, social and corporate governance (ESG) investing. Both companies share a commitment to decarbonization and BlackRock sees the deal’s timing as opportune, as governments have offered businesses rare financial incentives to build infrastructure, including for green energy projects, according to a press release.

Read More